Ex-IRS Agent Reveals How to Eliminate Your Tax Debt – Remove a Tax Lien - Remove Tax Penalties With No Expensive Services Needed

If you’re reading this, it’s probably because the IRS is breathing down your neck.

You might owe thousands – or even tens of thousands – in back taxes, or worse, there is a lien on your property.

You might have already considered calling a tax debt company to help you out.

But what if I told you that you don’t need to hire anyone?

Secrets from a former IRS agent have just been uncovered that show how you can eliminate your tax debt on your own – and you can do it for a fraction of the cost that companies charge.

Let’s get real for a moment:

- The IRS doesn’t want you to know how easy it can be to resolve tax debt if you just know the right steps to take.

Most tax debt companies charge thousands of dollars to “negotiate” on your behalf.

The truth…

They’re using simple templates and tactics that you could use yourself – if you had access to the insider knowledge they have.

The truth about Tax Debt Companies...

They cannot negotiate anything better than you can using the exact same templates they use.

You can remove penalties and interest just like they do using this one document template.

It’s the same template that this former IRS agent uses in his private practice and charges $7,999.00 for. I’ll show you how you can get it for pennies on the dollar!

Here’s the big secret...

A former IRS agent, someone who knows exactly how the system works, is now pulling back the curtain on how to settle your tax debt yourself, without hiring overpriced consultants or firms.

This insider is revealing step-by-step templates and tools that anyone can use to slash their tax debt or get liens removed.

And the best part?

You don’t need to be a tax expert to do it.

This former agent has worked within the IRS for over a decade and knows all the tricks they use to keep people paying more than they should.

With this knowledge, you’ll be able to:

- Reduce your tax debt by up to 80%

- Remove tax liens from your property without paying for an attorney

- Stop IRS penalties and interest from piling up even further

- Negotiate directly with the IRS using templates that are 100% proven to work

What’s in it for you?

Instead of paying thousands to a tax relief company that will do the same thing, you can take control of the process yourself.

I’ve created an AI Tax Assistant to help you analyze your exact situation. Then help you to professional prepare your forms using the exact templates I use in my office. So all you need to do is print and mail them to the IRS yourself!

You’ll have full access to the exact templates, letters, and negotiation scripts used by IRS insiders – for pennies on the dollar.

Plus you’ll get my personson video training on how to

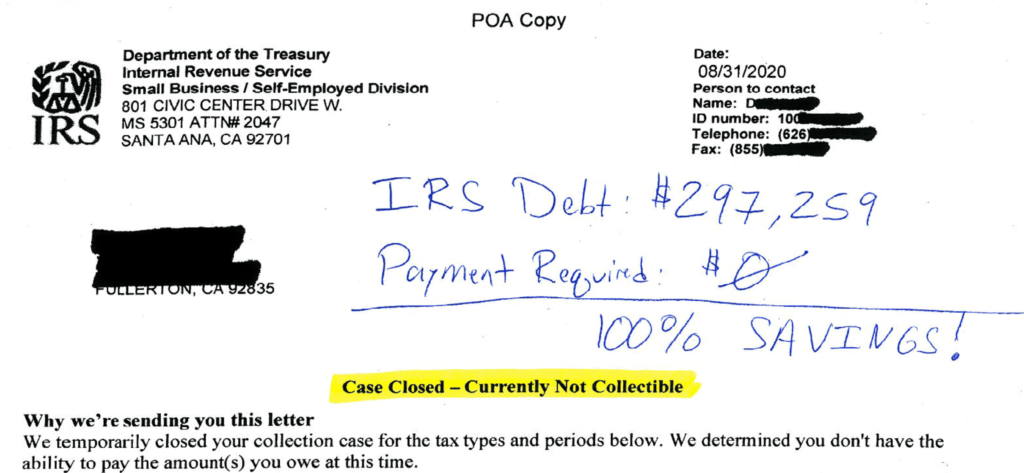

Husband and Wife Owe IRS $297,259.

You’ll be able to do exactly what this husband and wife owed the IRS $297,259 but were in no position to pay it. We’re able to do it ourselves!

The couple spent a lot of time, money, and heartache attempting to resolve their IRS matter on their own without success.

Eventually, they did reach out to “tax relief” firms, but these so-called firms were more than happy to take advantage of the couple, who just needed help.

Finally, they found templates provided by this former IRS Agent, and they immediately went to work. They prevented IRS tax levies, protected their income and assets from IRS hands, stopped enforcement action, and gave themselves the time they needed to get through the pandemic while keeping their home and caring for their unique medical needs.

While they owed $297,259 to the IRS, they were able to secure a financial hardship approval from the agency after prevailing in IRS Appeals. This resulted in NO required payments to the IRS — a 100% savings!

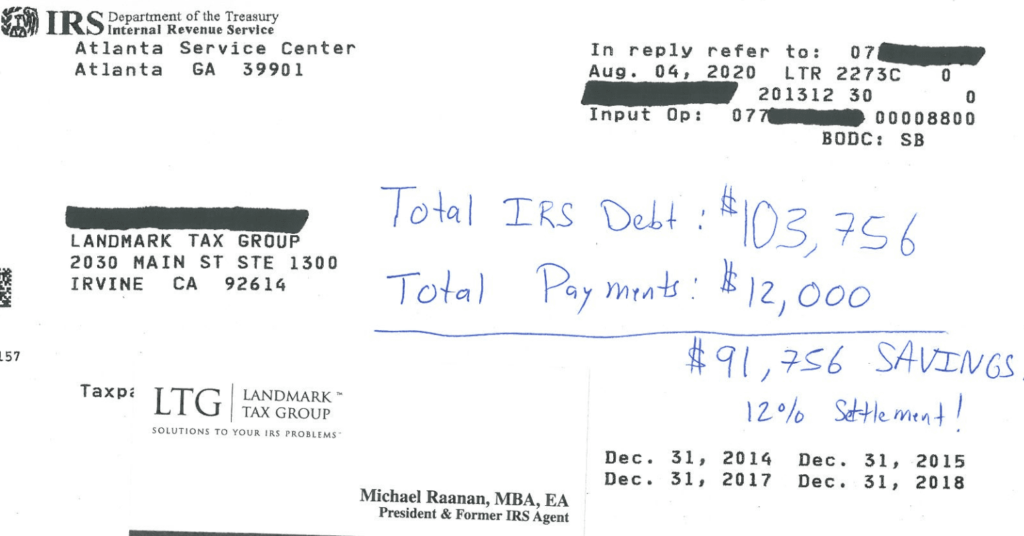

$103,756 IRS Balance Resolved For $12,000!

How one man eliminated $91,756 off his tax debt balance.

John lost 40% of his income during the COVID-19 pandemic. To make matters more complicated, he owed the IRS $103,756. There was no way he would be able to manage this kind of debt and be able to get through the pandemic with his head above water. He was devastated.

John discovered successfully put an end to IRS enforcement action. This allowed John to get through the ongoing pandemic with one less thing to worry about — the IRS would not be breathing down his neck.

As a result, he kept his home and had his income and assets protected. The IRS would not be putting any levies on his income, as they often do in these types of situations.

More than that, John negotiated the IRS down from the initial $103,756 balance. Instead, John would only have to pay a total of $12,000! This represents just 12% of what he owed — and a savings of $91,756!

You can do this yourself, some of the results of other Do It Yourself IRS Warriors!

You don't need to pay a Tax Firm thousands when you can do it yourself!

Tax Debt: $94,215 owed to the IRS

Results: Prevented IRS enforcement action, protected income and assets, and arranged a payment plan of $100/month, totaling only $6,000 – a settlement of just 6% with a savings of over $88,215!

View Internal Revenue Service (IRS) Document

Tax Debt: $44,433.73 owed to the IRS

Results: Full removal of $67,945.25 penalty, removal of $2,692.03 interest, and issuance of a refund check of $26,203.55 to the taxpayer!

View Internal Revenue Service (IRS) Document

Tax Debt: $109,652 owed to the IRS

Results: Prevented IRS enforcement action, protected income, and assets, a settlement totaling only $14,634. A 86% savings!!

View Internal Revenue Service (IRS) Document

Tax Debt: $297,259 owed to the IRS

Results: Secured Financial Hardship status. No payment required!

View Internal Revenue Service (IRS) Document

Tax Debt: $103,756 owed to the IRS

Results: Prevented IRS enforcement action, protected income and assets, and arranged a payment plan of $100/month, totaling only $12,000 – a settlement of just 12% with a savings of over $91,756!

View Internal Revenue Service (IRS) Document

Tax Debt: $414,992 owed to the IRS

Results: Secured Financial Hardship status. No payment required!

View Internal Revenue Service (IRS) Document

Tax Debt: $97,345 owed to the IRS

Results: Arranged a monthly installment plan totaling $27,625 – a savings of 72%!

View Internal Revenue Service (IRS) Document

Tax Debt: $82,293 owed to the IRS

Results: Secured an installment agreement for monthly payments of $622, resulting in an 82% savings!

View Internal Revenue Service (IRS) Document

Tax Debt: $136,318 owed to the IRS

Results: Arranged a monthly installment plan totaling $15,984 – a savings of 88%!

View the Official IRS Document

Tax Debt: $131,379 owed to the IRS

Results: Secured Financial Hardship status. No payment required!

View the Official IRS Document

Tax Debt: $60,013 owed to the IRS

Results: Secured an installment agreement for small $200 monthly payments, resulting in a 77% savings!

View Internal Revenue Service (IRS) Document

Tax Debt: $500,717 owed to the IRS, resulting in a tax lien on the client’s home, preventing the sale of their property.

Results: Secured a Tax Lien Certificate of Discharge, with the IRS granting permission for the client’s home to be sold despite a tax lien!

See Official IRS Certificate of Discharge

Tax Debt: $130,601 owed to the IRS

Results: $93,616 in interest and penalties removed, for a 70% reduction in tax debt!

View Internal Revenue Services (IRS) Document

Tax Debt: $128,602 owed to the IRS

Results: Secured monthly payments of just a low $150 per month, for an 88% savings!

View Internal Revenue Services (IRS) Document

Tax Debt: $8,000 in late fee penalties

Results: 100% of penalties removed!

View Internal Revenue Services (IRS) Document

Tax Debt: $85,863 owed to the IRS in tax and penalties.

Results: Only $4,257 payment required. A 95% savings!

View Internal Revenue Service (IRS) Document

Tax Debt: $4,680 owed to Internal Revenue Service (IRS) in tax and penalties.

Results: No payment required! All fees and penalties were reversed — and the IRS also paid interest back to the taxpayer.

View Internal Revenue Service (IRS) Document

Tax Debt: $93,490 owed to Internal Revenue Service (IRS) in tax and penalties.

Results: Obtained IRS Offer-in-Compromise tax debt settlement of just $5,176, a savings of over 95%.

View Internal Revenue Service (IRS) Document

Tax Debt: $31,097 owed to the State of California Franchise Tax Board (FTB) in tax and penalties.

Results: Full release of tax levies, settlement of $185/month payment plan.

View Franchise Tax Board (FTB) Document

Tax Debt: $137,967 owed to Internal Revenue Service (IRS) in tax and penalties.

Results: Obtained IRS Offer-in-Compromise tax debt settlement of just $864, a savings of over 99.37%.

View Internal Revenue Service (IRS) Document

Tax Problem: Taxpayer could not sell home because of a $137,185.80 IRS Tax Lien

Results: Secured an approval from the IRS to “discharge” the property from the Federal Tax Lien so it can be sold with zero funds going to the IRS. See the official Certificate of Discharge below.

View Internal Revenue Service (IRS) Document

Tax Debt: $41,558 owed to Internal Revenue Service (IRS) in tax and penalties.

Results: Prevention of tax levies and lien, reduction of tax and penalties to $18,241. Remaining balance placed in Currently-Not-Collectible (financial hardship) settlement closure. No payment required.

View Internal Revenue Service (IRS) Document

Tax Debt: $50,104 owed to Internal Revenue Service (IRS) in tax and penalties.

Results: Prevention of tax levies and lien, reduction of tax and penalties to $12,330. Remaining balance placed in Currently-Not-Collectible (financial hardship) settlement closure. No payment required.

View Internal Revenue Service (IRS) Document

Tax Debt: $66,970 owed to Internal Revenue Service (IRS) in tax and penalties.

Results: Prevention of tax levies, removal of 100% of taxes and penalties.

View Internal Revenue Service (IRS) Document

Tax Debt: $145,372 owed to Internal Revenue Service (IRS) in tax and penalties.

Results: Prevention of tax levies, obtained Currently-Not-Collectible (financial hardship) settlement. No payment required.

View Internal Revenue Service (IRS) Document

Tax Debt: $82,000 owed to Internal Revenue Service (IRS) in tax and penalties.

Results: Prevention of tax levies, settlement of $695/month payment plan, 100% removal of 2008 penalties, 90% removal of penalties for remaining periods via IRS Appeals.

View Internal Revenue Service (IRS) Document

Tax Issue: IRS took a $4,293.50 tax refund and applied it to an ex-spouse’s tax liability.

Results: IRS approved our Injured Spouse Claim and refunded 100% of the funds back to the taxpayer. View Internal Revenue Service (IRS) Document

Tax Issue: $11,954.00 owed to Internal Revenue Service (IRS) in penalties.

Results: Removal of 100% of the penalty. No payment required.

View Internal Revenue Service (IRS) Document

Tax Debt: $49,700 owed to Internal Revenue Service (IRS)

Results: Removal of over $7,146+ in penalties and obtained Currently-Not-Collectible (financial hardship) settlement closure. No payment required.

View Internal Revenue Service (IRS) Document

Tax Debt: $18,495 owed to Internal Revenue Service (IRS)

Results: Prevention of tax levies, removal of penalties, settlement of $150/month payment plan. This business taxpayer will only be making three payments — paying only less than 3% of the total tax debt.

View Internal Revenue Service (IRS) Document

Tax Debt: $17,231 owed to Internal Revenue Service (IRS)

Results: Prevention of tax liens and levies, removal of penalties, settlement of $238/month payment plan.

View Internal Revenue Service (IRS) Document

Tax Debt: $38,124 owed to California Franchise Tax Board (FTB)

Results: Prevention of levies, settlement of $100/month payment plan.

View California Franchise Tax Board (FTB) Document

Tax Debt: $127,889 owed to Internal Revenue Service (IRS) and $10,000 owed to California Franchise Tax Board (FTB)

Results: Removal of levies, removal of penalties and obtained Currently-Not-Collectible (financial hardship) closure. No payment required.

View Internal Revenue Service (IRS) Document

Tax Debt: $28,032.11 owed to Internal Revenue Service (IRS)

Results: IRS approval of Innocent Spouse Claim resulting in full removal of the tax, penalties and interest.

View Internal Revenue Service (IRS) Document

Tax Debt: $93,554 owed to Internal Revenue Service (IRS)

Results: Removal of penalties and related interest, settlement of $100/month payment plan.

View Internal Revenue Service (IRS) Document

Tax Debt: $197,317 owed to Internal Revenue Service (IRS)

Results: Full stop of levy action, settlement of $100/month payment plan.

View Internal Revenue Service (IRS) Document

Tax Debt: $103,609 owed to Internal Revenue Service (IRS)

Results: Full stop of levy action, removal of penalties and interest, settlement of $100/month payment plan.

View Internal Revenue Service (IRS) Document

Tax Debt: $54,000 owed to California Franchise Tax Board (FTB)

Results: Prevention of a tax levy, settlement of $100/month payment plan.

View Franchise Tax Board (FTB) Document

Tax Debt: $20,000 owed to Internal Revenue Service (IRS)

Results: Full removal of $4,385 in penalties and interest, prevention of a tax lien, settlement of $300/month payment plan.

View Internal Revenue Service (IRS) Document

Tax Debt: $96,005 owed to California Franchise Tax Board (FTB)

Results: Full removal of $96,005 tax liability, release of wage levy, release of tax lien, and issuance of tax refunds to the taxpayer.

View California Franchise Tax Board (FTB) Document

Tax Debt: $25,220.50 owed to California Franchise Tax Board (FTB)

Results: Full removal of $25,220.50 penalty and issuance of a refund check of $7,253.31.

View California Franchise Tax Board (FTB) Document

Tax Debt: $130,000 owed to Internal Revenue Service (IRS)

Results: Settlement of $113/month payment plan.

Tax Debt: $343,947

Results: Obtained Currently-Not-Collectible (financial hardship) closure. No payment required.

Tax Debt: $104,728

Results: Obtained Currently-Not-Collectible (financial hardship) closure. No payment required.

Penalties Removed: $9,835.29

Tax Debt: $100,017

Results: Obtained Currently-Not-Collectible (financial hardship) closure. No payment required.

Tax Debt: $123,704 California Franchise Tax Board

Results: $100/mth payment plan

Tax Debt: $65,098

Results: $100/mth payment plan

Tax Debt: $58,106 in business taxes

Results: $100/mth payment plan

Tax Debt: $137,222 California Franchise Tax Board

Results: $121/mth payment plan

View California Franchise Tax Board (FTB) Document

Tax Debt: $220,000

Results: Reduced liability by $142,000 and obtained a Currently-Not-Collectible (financial hardship) closure on the remaining balance. No payment required.

Tax Debt: $36,083

Results: Obtained Currently-Not-Collectible (financial hardship) closure. No payment required.

Tax Debt: $114,903

Results: $100/mth payment plan

Tax Debt: $1,093,449

Results: $600/mth payment plan

Here’s the deal:

The IRS isn’t going to tell you about these programs, and the clock is ticking. Every day you wait, your debt grows with penalties and interest. But now, you have the power to fight back – without anyone’s help.

For a limited time, we’re offering a complete, easy-to-follow guide created by this former IRS agent, along with the exact templates and instructions to help you:

- Settle your debt for a fraction of what you owe

- Lift property liens

- Stop the IRS from ever threatening you again

Our Tax Assistant AI will generate your IRS Tax Documents for you to submit, using the IRS Templates Approved by this Former IRS AGENT.

All you need to do is answer a few questions and Your Tax Assistant will generate all the document you need to print, sign and mail to the IRS to remove penalties, remove liens and levies, setup payment installments and much more.

Ready to take control?

For a one-time cost of just $299, you’ll get instant access to everything you need to resolve your tax debt and break free from the IRS – all from the comfort of your home.

Why spend thousands on a tax debt company when you can do it all yourself for a fraction of the price?

Get Started Today by using the form below to instantly access your Tax Assistant now, and finally get the IRS off your back for good.

Tax Assistant AI

For a limited time, we’re offering a *complete, easy-to-follow guide* created by this former IRS agent, along with the *exact templates* and instructions to help you:

– *Settle your debt for a fraction of what you owe*

– *Lift property liens*

– Stop the IRS from ever threatening you again

Chinese (Simplified)

Chinese (Simplified) English

English Spanish

Spanish