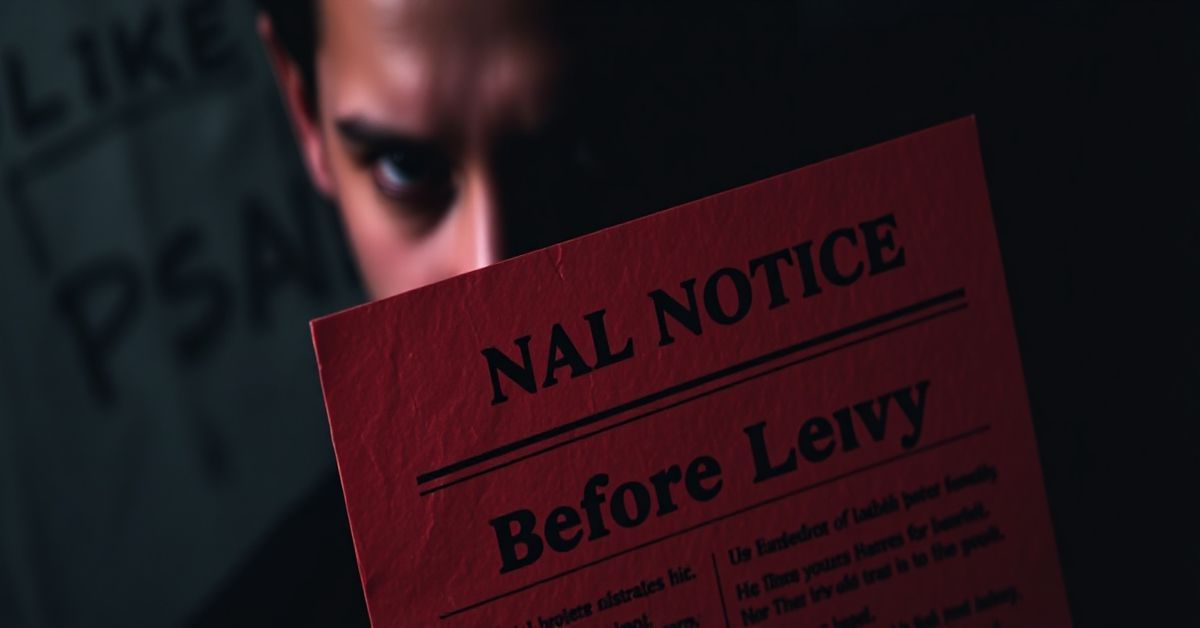

What is an IRS Notice CP504: Final Notice Before Levy?

Receiving mail from the IRS can be stressful, especially when it’s marked “Final Notice Before Levy.” If you’ve received a CP504 notice, it means the IRS is done with gentle reminders. They are moving to the next stage—a levy. Let’s break down what this means and what you need to do.

Why Did I Get an IRS Notice CP504?

An IRS Notice CP504 is a very specific type of notice. It’s not just a general tax reminder. It’s specifically sent out as a final warning when you have:

- Unpaid Taxes: You owe the IRS money from previous tax returns.

- Previous Notices Ignored: The IRS has already sent you other notices and likely attempts to contact you about your outstanding tax debt.

- No Payment Arrangement: You haven’t responded to previous notices or have not made arrangements to pay your tax debt, like a payment plan.

Think of it like this: The IRS has tried to reach out, and now they’re saying, “Okay, it’s time to take more serious action.” The CP504 is the last chance to handle things proactively before they escalate to a levy.

What Does a “Levy” Mean?

A levy is a legal seizure of your property to satisfy an unpaid tax debt. It’s different from a lien. A lien is the IRS’s legal claim against your property, while a levy is the actual seizure of your property. With a levy, the IRS can take:

- Your Bank Accounts: Money from your checking and savings accounts.

- Your Wages: A portion of your paycheck will go directly to the IRS.

- Other Assets: Vehicles, real estate, and other valuable possessions.

The IRS is not just threatening here; the Notice CP504 means they’re actually moving toward a levy.

How a CP504 Notice Works

The CP504 notice will contain very important information about your situation, including:

- Amount Owed: The exact amount of tax, penalties, and interest you owe.

- Deadline to Pay: A specific date by which you need to pay or make other arrangements.

- IRS Contact Information: The IRS phone number and address to use for inquiries and payments.

- Information on Your Rights: Details on your rights and possible options, including setting up a payment plan or other alternatives.

- Explanation of Levy: A clear explanation of what a levy is and how it will affect you.

It’s incredibly important to read every single word on this notice very carefully. Missing something could lead to a levy of your bank accounts or wages.

Time is of the Essence

You will notice that you have a deadline specified on the CP504 notice. This isn’t optional. Time is very short, and action must be taken immediately! After that deadline passes, the IRS can proceed with a levy without sending further notices (unless required to by law for certain property). This means the IRS can take your money without giving you much more warning, and they do not need permission from a court to seize your assets with a levy.

What Should You Do After Receiving a Notice CP504?

If you have received an IRS Notice CP504, do not panic! You still have options. Here’s what you should do:

- Review the Notice Carefully: Understand the amount you owe and the deadline.

- Contact the IRS Immediately: Call the IRS phone number on the notice. Be prepared to explain your situation.

- Explore Payment Options: Discuss the possibility of setting up a payment plan, called an installment agreement, with the IRS.

- Offer in Compromise (OIC): Depending on your financial situation, you may qualify for an Offer in Compromise, where the IRS may agree to accept a lower amount than you owe.

- Request a Collection Due Process Hearing: You can request a CDP hearing with the IRS’s Independent Office of Appeals to review your case.

- Consider Professional Help: If you’re overwhelmed, consult with a tax professional (CPA, enrolled agent, or tax attorney). They can help you navigate the IRS and explore the best way to handle your tax debt.

Understanding Installment Agreements

One of the most common actions taxpayers take when they get a CP504 notice is to explore an installment agreement. The IRS will usually agree to this if you’re upfront and willing to pay the amount over time. An installment agreement allows you to make monthly payments until the full debt is paid off. The specifics can vary depending on your debt amount and the length of the agreement, but it gives you a chance to avoid a levy while getting caught up on your taxes.

Offer In Compromise (OIC): A Possible Debt Reduction

If you can’t pay your taxes in full, and even an installment agreement seems out of reach, you might be able to use an Offer in Compromise, or OIC. With this program, you can offer to settle your tax debt for a smaller amount than what you actually owe. The IRS will take into consideration many factors like your income, your assets, and your ability to pay. The IRS does not accept all OICs, and you must meet specific requirements for the agency to consider it. It’s not guaranteed, but definitely worth exploring if you are in a serious financial situation.

Professional Tax Help

Navigating the complex world of tax debt and IRS notices can be confusing and overwhelming. This is why many people choose to work with tax professionals such as Certified Public Accountants, or CPAs, enrolled agents, or tax attorneys. They are very knowledgeable about the system, and they can guide you through the best course of action based on your situation, and also represent you when you’re dealing with the IRS. If you are not sure of your next steps, or you feel lost in the process, it is beneficial to consult a tax professional for guidance.

Common Misconceptions About the IRS Notice CP504

There are some common misunderstandings about this notice. Let’s clear those up:

- It’s Not a Joke: This is the final notice before serious action is taken. Don’t ignore it.

- You Can’t Always Just “Ignore” the IRS: The IRS can and will take action if you don’t respond.

- It Does Not Mean You’re in Big Trouble: You have options and can work out a solution with the IRS.

- You Are Not Alone: Many taxpayers receive these notices, and you can get help.

What Happens if You Do Nothing?

Ignoring a CP504 notice is the worst thing you can do. If you fail to act, the IRS will proceed with the levy process. This means:

- Your Bank Accounts Could be Emptied: The IRS can legally take all the money in your accounts, up to the amount of your tax debt.

- Your Wages Could Be Garnished: A portion of your paycheck will be sent directly to the IRS, limiting your access to your income.

- Other Assets Seized: The IRS can take your cars, real estate, and other valuable items.

By acting immediately, you can avoid these severe consequences.

Related Concepts/Terms

- Tax Lien: A legal claim the IRS has on your property as security for unpaid taxes.

- Tax Levy: The actual seizure of your property to satisfy unpaid taxes.

- Installment Agreement: A payment plan with the IRS.

- Offer in Compromise (OIC): An agreement with the IRS to settle your debt for less than what you owe.

- Collection Due Process (CDP) Hearing: A chance to dispute the IRS’s collection actions through the Independent Office of Appeals.

- IRS Notices: Different letters the IRS sends out related to your tax return and potential issues.

In Conclusion

An IRS Notice CP504 is serious, but it’s also a clear warning that you have one last chance to act before your assets are at risk. Don’t panic. Take action immediately. By understanding your options and taking steps to address the problem, you can avoid a levy and get your tax situation back on track. Always remember that the IRS wants to work with you, but it’s your responsibility to reach out and find a resolution.