What Exactly is a Fraud Penalty?

Let’s be clear: making a simple mistake on your taxes is different from committing tax fraud. Everyone makes errors; those are usually addressed with other kinds of penalties. A fraud penalty, on the other hand, is for those who intentionally lie, mislead, or try to cheat the system. It’s a serious matter because it undermines the entire tax system. The IRS doesn’t impose this penalty for accidental mistakes or misunderstandings. They only do so when they believe that you knowingly and intentionally tried to evade taxes.

The Difference Between a Mistake and Tax Fraud

It’s essential to understand the difference between an honest error and tax fraud. A simple mistake, like miscalculating an amount or forgetting a deduction, is usually not considered fraud. These errors are often addressed with accuracy-related penalties, which are typically lower than fraud penalties. These errors happen, and the IRS usually understands. On the other hand, fraud requires intent. Think of it like this: if you accidentally hit another car while trying to park, that’s an accident. If you intentionally drove your car into another vehicle with the intent to damage it, that’s more than just an accident. Tax fraud is similar. It involves a deliberate act designed to avoid paying taxes. Examples include creating fake receipts, hiding income, or using someone else’s identity to avoid taxes.

How Does the IRS Determine if It’s Fraud?

The IRS doesn’t just throw around the term “fraud” lightly. They have to prove that you intentionally tried to avoid your tax obligations. This involves looking at the facts and circumstances of your case. Some common elements the IRS looks for to prove intent include:

- Underreporting Income: Did you knowingly fail to report a significant amount of income? For instance, if you have a side hustle but purposely don’t report that income.

- Falsifying Deductions or Credits: Did you claim deductions or credits you knew you weren’t entitled to? Like inventing expenses for a business you don’t have or claiming dependents you don’t support.

- Concealing Assets: Did you try to hide assets to make it look like you had less money than you actually did? This can include transferring assets to other individuals.

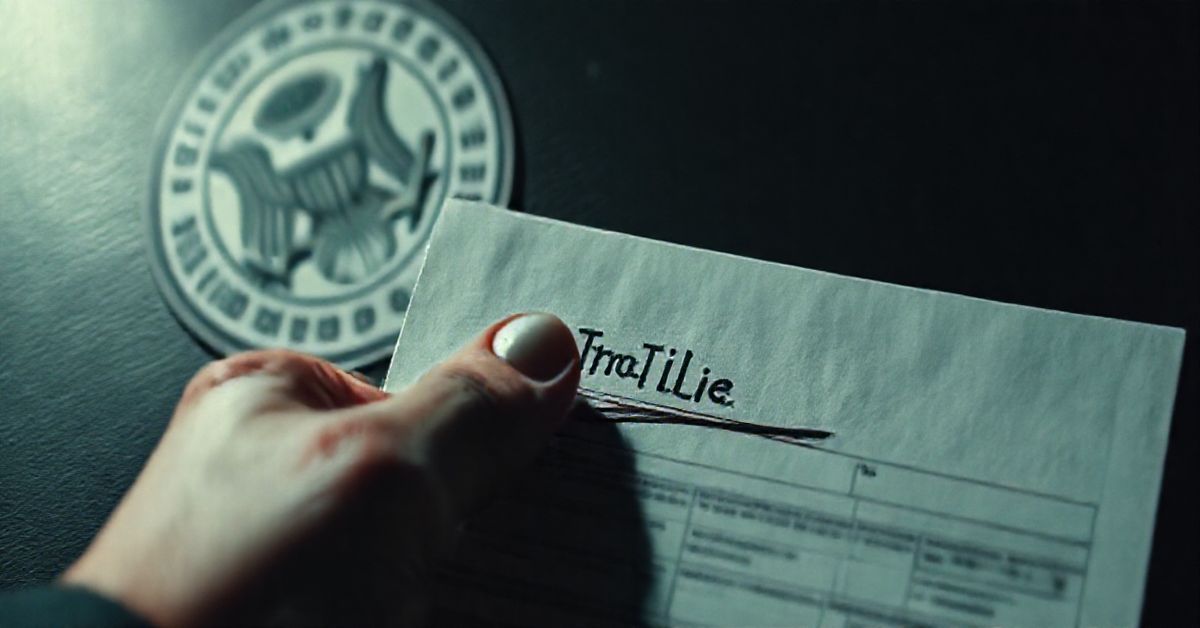

- Using False Documents: Did you provide fake receipts, invoices, or other documents to support false claims on your taxes?

- Keeping Two Sets of Books: Did you maintain one set of records for yourself and another with incorrect information for the IRS?

The IRS will gather evidence through audits, investigations, and documentation to establish that your actions were intentional and not the result of an error. It’s not always black and white, and a lot of investigation goes into these matters.

The Importance of Good Recordkeeping

This makes good bookkeeping even more important. It’s crucial to maintain accurate and detailed records of all your income and expenses. This helps you accurately file your taxes and provides you with a good defense if there’s ever a question about your return. Good records can help prove that you weren’t trying to mislead the IRS.

Who is at Risk of a Fraud Penalty?

Honestly, anyone can technically be at risk of a fraud penalty if they knowingly attempt to cheat on their taxes. However, certain situations can make a person more vulnerable to being investigated for potential fraud. This could include:

- Those with complex financial situations: Individuals with multiple income streams, business owners, and those with investments can sometimes find themselves in a confusing position where it can be easier to accidentally slip up or be tempted to take a shortcut, which could be considered fraudulent.

- Those who participate in “tax avoidance” schemes: If you try to use a scheme that sounds too good to be true, be warned. They often involve fraudulent behavior.

- Those who hire unscrupulous tax preparers: Sometimes people hire a preparer who doesn’t have good ethics. In such cases, they might knowingly file a fraudulent return for you, and unfortunately, you’re responsible for your tax return.

- Those who are dealing with financial hardship: Desperate financial situations can unfortunately push people to make desperate decisions. But again, tax fraud is not the answer to debt.

It’s important to note that just because you fit into one of these categories doesn’t mean you’re committing fraud. It just means you need to be extra careful and ensure you’re doing everything correctly.

How High Are Fraud Penalties?

The IRS doesn’t mess around when it comes to tax fraud. The penalties are steep because they want to deter people from even thinking about cheating. A fraud penalty is typically 75% of the underpaid tax, which is a substantial amount. Think about it: if you underpaid $10,000 in taxes because of fraud, you could be penalized an additional $7,500. In addition, you’ll still owe the initial $10,000 in back taxes.

This doesn’t include any interest that might accrue on the underpayment, or other penalties they might tack on. For example, if the IRS finds fraud when an audit is performed, the taxpayer may need to pay for the cost of the audit.

What Happens If You’re Accused of Tax Fraud?

If the IRS suspects you’ve committed tax fraud, they will investigate thoroughly. You will receive a notice informing you of their findings and the proposed penalties. At that point, you have several options:

- Agree with the Findings: If you agree with the IRS’s assessment, you’ll pay the underpaid taxes, penalties, and interest.

- Disagree with the Findings: If you disagree with the findings, you have the right to appeal their decision and present your case. This will likely involve submitting evidence to dispute the IRS’s assessment.

- Seek Professional Help: It’s best to seek help from a tax attorney or CPA experienced with these matters. They can guide you through the complex process, help you prepare your case, and represent you in your appeal. They can also help you with the negotiation process, and perhaps reduce or abate the penalty in some situations.

This is definitely not something to take lightly. The process can be lengthy, stressful, and expensive. It’s best to be proactive and ensure you’re always filing your taxes correctly.

How to Avoid Fraud Penalties?

The simplest way to avoid fraud penalties is to be honest and accurate on your tax return. Here are some other practical steps you can take:

- Keep Good Records: Meticulous record-keeping is crucial. Keep all receipts, bank statements, and other documentation that will back up your deductions and income.

- Report All Income: Don’t try to hide income from any source, even if it’s small or you think the IRS won’t find out.

- Be Honest About Deductions and Credits: Only claim deductions and credits you actually qualify for.

- Consult a Professional: If you’re unsure about a complicated tax issue, consult a qualified tax professional for help. It’s money well spent to make sure you are in compliance.

- Don’t Wait to File: Don’t wait until the last minute to file your taxes. Rushing usually leads to mistakes. Give yourself time to gather the information and properly prepare your tax return.

The best strategy is to be truthful and forthright with the IRS. Remember, mistakes happen, but deliberate deception won’t fly.

Other Related Tax Penalties

While fraud penalties are some of the most severe, they aren’t the only penalties the IRS can impose. Others include:

- Accuracy-Related Penalties: This applies to underpayment resulting from carelessness or disregard of rules, but not intentional fraud. They are less severe than fraud penalties.

- Failure-to-File Penalty: This is a penalty for not filing your return by the due date.

- Failure-to-Pay Penalty: This is a penalty for not paying your taxes on time.

It’s best to stay on top of your tax obligations and take care to ensure you aren’t in a position where you have to deal with any of these penalties.

Common Misconceptions About Fraud Penalties

There are a few misunderstandings people have about fraud penalties:

- “The IRS won’t know if I cheat a little”: The IRS has sophisticated systems for detecting fraud. Don’t think you can get away with being dishonest on your taxes. It’s very rarely worth it.

- “My tax preparer is responsible for my taxes, not me”: While you may use a preparer, you are ultimately responsible for the accuracy of your return, so ensure you’re comfortable with the return you’re signing.

- “It’s just a simple mistake, they won’t think it’s fraud”: If the mistake is big enough, especially if the IRS believes you intentionally mislead them, it’s possible you could be investigated for fraud.

Final Thoughts

Tax fraud is a serious offense with significant consequences. The IRS doesn’t issue these penalties lightly. Understanding what it is, how to avoid it, and what to do if you’re accused will help you stay out of trouble with the IRS. The key takeaway is always to be truthful, accurate, and proactive when dealing with your taxes. This is not an area to try to cut corners.