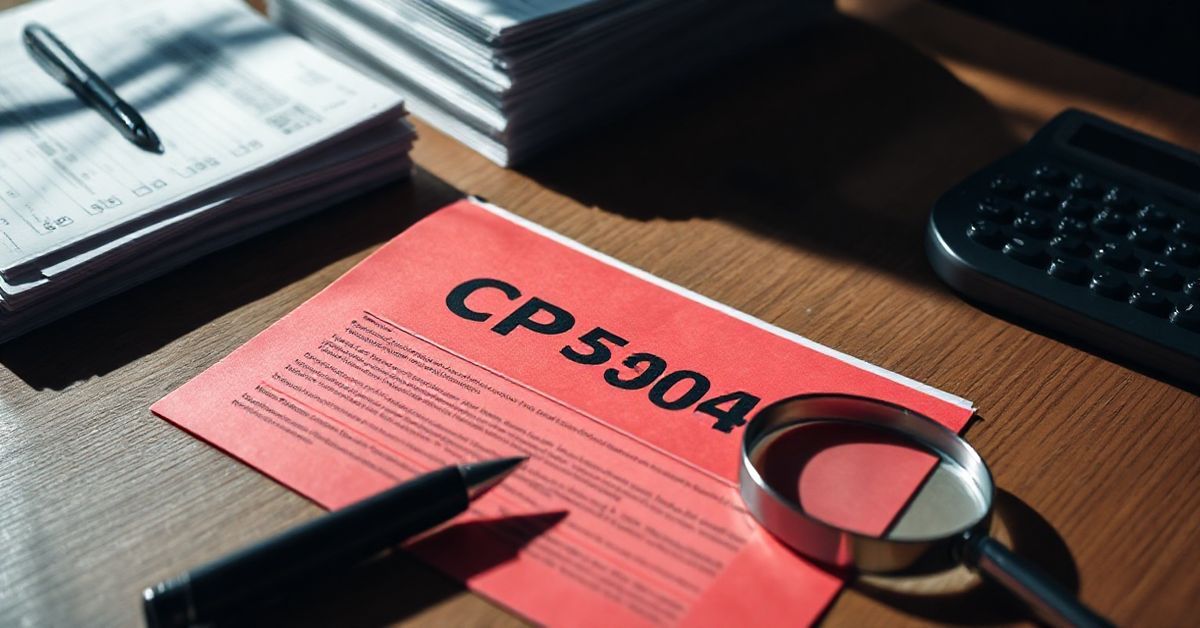

CP504 Notice – Notice of Intent to Levy

What Does an IRS CP504 Notice – Notice of Intent to Levy Mean?

A CP504 Notice, also known as a Notice of Intent to Levy, is an official IRS document informing you that they plan to seize your property (like bank accounts, wages, or other assets) if you don’t pay your outstanding tax debt. This notice is a serious step by the IRS that signals potential enforcement actions.