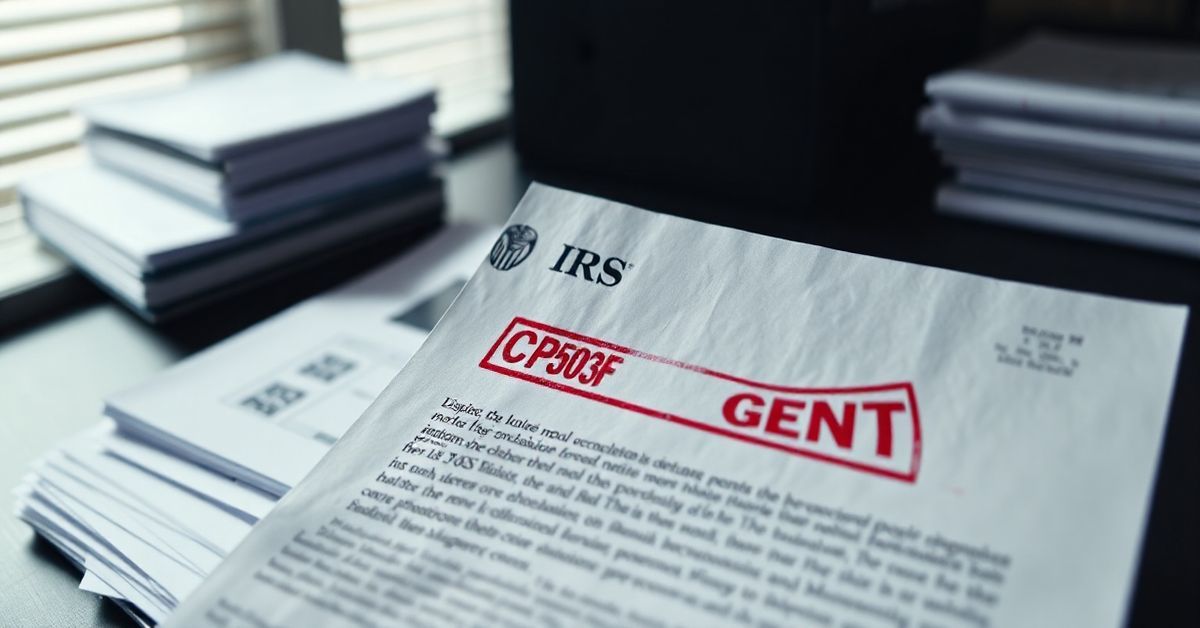

Understanding the IRS CP503F Notice: An Urgent Reminder

It can be a little nerve-wracking to get a letter from the IRS, especially one that uses the word “urgent.” The CP503F notice is one of those letters you definitely don’t want to ignore. Let’s break down what it is, what it means for you, and what you should do next.

What Triggers a CP503F Notice?

Think of the CP503F notice as a follow-up from the IRS. It’s generally sent after other initial notices have been issued regarding unpaid taxes. This notice isn’t the first heads up that you owe money, but it’s certainly a clear signal that the IRS is getting more serious about collecting what’s due. Essentially, you’ve missed payments on taxes you owe, and the IRS needs you to take action.

Why Am I Getting This Specific Notice?

You might be wondering why the IRS specifically sent you a CP503F notice, not some other letter. Here’s the breakdown:

- Unpaid Balance: You filed your taxes (or the IRS determined you owe taxes) but haven’t paid the full amount due.

- Previous Notices: Before a CP503F, the IRS usually sends earlier notices requesting payment. If these are ignored, then a CP503F is next in line.

- Time Sensitive: The CP503F emphasizes the urgent need to resolve your tax debt.

- Potential for Escalation: This notice indicates that the IRS is moving toward more aggressive methods of debt collection if you don’t act soon.

What Information Does the CP503F Notice Contain?

The CP503F notice isn’t just a “pay up” letter; it gives you a lot of specific information. It’s important to read it carefully. Here’s what you can expect to find:

- Your Tax ID: Your Social Security Number (SSN) or Employer Identification Number (EIN), to identify your account.

- Tax Year: The specific tax year for which you owe the balance.

- Amount Owed: The exact total of unpaid taxes, penalties, and interest due.

- Payment Deadline: A date by which the IRS expects you to pay the outstanding debt.

- Payment Options: Instructions on how to make a payment, such as online, by phone, or by mail.

- Contact Information: How to reach the IRS to discuss your account or payment options.

- Warning of Consequences: The CP503F notice will clearly state that failure to pay may lead to further collection actions such as wage garnishments or bank levies.

What Should You Do if You Receive a CP503F Notice?

Receiving a CP503F notice can feel overwhelming. But it’s crucial to act quickly and in the right way to resolve the issue.

Step 1: Verify the Information

Carefully check all information on the notice to make sure it is correct. Verify your name, tax ID, tax year, and the amount owed. If you believe there has been an error, contact the IRS immediately to address the discrepancy.

Step 2: Don’t Ignore It

The worst thing you can do is ignore the CP503F notice. The IRS isn’t going to forget about your unpaid taxes. Ignoring the notice will make things worse, leading to more penalties, interest, and increasingly aggressive collection actions.

Step 3: Pay the Full Amount Due, If Possible

If you can pay the full amount owed, you should do so by the payment deadline stated on the CP503F notice. This will stop further penalties and collection actions.

Step 4: Set Up a Payment Plan If You Can’t Pay Immediately

If you cannot pay the full amount right away, don’t panic. The IRS offers payment plans and other options to help taxpayers who need to pay their tax liability over time. Here are some options to consider:

- Short-Term Payment Plan: If you need a bit more time, you can request up to 180 days to pay the balance fully.

- Installment Agreement: If you need more than 180 days, you can request a monthly installment agreement. This allows you to pay off your tax debt in smaller amounts over a longer period of time.

- Offer in Compromise (OIC): In very specific cases, the IRS might accept an OIC, where you pay a smaller amount than what you owe. This is rare and requires a detailed application, so you should speak with a qualified tax professional before applying for an OIC.

Step 5: Contact the IRS

If you have any questions about the CP503F notice, payment options, or other concerns, contact the IRS immediately. Use the contact information provided in the notice or go to the IRS website for more information.

Step 6: Consider Professional Help

Tax laws can be complex, especially when dealing with tax debt. If you’re feeling confused or overwhelmed, consult with a tax professional. A CPA, enrolled agent, or tax attorney can help you understand the situation, develop a plan of action, and negotiate with the IRS on your behalf.

What Are the Potential Consequences of Ignoring a CP503F Notice?

Ignoring the CP503F notice has serious consequences. Here are some possibilities:

- Additional Penalties and Interest: Penalties and interest will continue to accrue on the unpaid balance.

- Wage Garnishment: The IRS can garnish a portion of your paycheck to recover the tax debt. This means your employer will be required to send part of your salary directly to the IRS.

- Bank Levy: The IRS can levy your bank accounts, taking money directly from your checking and savings.

- Property Lien: The IRS can place a lien on your property. This makes it harder to sell or refinance and could lead to a forced sale.

- Passport Revocation: In some very serious cases with substantial unpaid debt, the IRS can take away your passport.

Avoiding Future CP503F Notices

The best approach to a CP503F notice is to avoid it in the first place. Here are some tips:

- Accurate Tax Filing: Ensure your tax return is filled out correctly and filed on time.

- Pay on Time: If you owe taxes, pay them by the deadline.

- Estimated Payments: If you’re self-employed or have other income that isn’t subject to withholding, make regular estimated tax payments throughout the year.

- Check Notices: Always open and carefully review any notices you receive from the IRS.

- Seek Help Early: If you know that you will have trouble paying your taxes, seek professional help right away, rather than waiting for a CP503F notice to show up.

Related Concepts and Terms

Understanding some related tax terms can help put the CP503F notice in context:

- Tax Lien: A legal claim against your property for unpaid taxes.

- Tax Levy: The IRS’s legal seizure of your property or funds to pay your tax debt.

- IRS Notice: Any official communication from the IRS, which may be for information, assessment, or collections.

- Offer in Compromise (OIC): A settlement between a taxpayer and the IRS where the IRS agrees to accept a payment less than the full amount owed.

- Penalty: Additional charge due to noncompliance, such as not filing or paying on time.

- Interest: A charge for late payments.

Common Misconceptions about the CP503F Notice

- It’s a Scam: The CP503F notice is an official IRS communication. It’s easy to mistake this as a scam so always verify the legitimacy of any notice.

- It will go away if I ignore it: Ignoring the IRS never makes things better.

- The IRS won’t seize my property: IRS collection actions will get increasingly serious and could eventually involve a bank levy or property lien.

- Payment plans are not an option: The IRS offers several options to help taxpayers manage their tax debt.

The CP503F notice is a serious matter that needs your prompt attention. Don’t panic, but don’t ignore it either. By understanding what the notice means, and by taking the appropriate action, you can navigate this challenge and find a solution to resolve your tax debt.